Page in Progress 12-23-2015

We do more than Roofing at

ARCM Incorporated.

ROOFING-PAINTING-GUTTERS-SIDING

Commercial Inspections

Loss Control

Surplus Lines

New Business

N.F.P.A Guidelines

Telephone Surveys: Fleet & Contractor Liability

Telephone Surveys: Worker's Compensation

Telephone Surveys: Customer Satisfaction

New Business & Re-Inspection Programs

Exterior Observation & Measurement Reports

Replacement Cost Surveys

Hazard & Liability Identification

Roof Rating & Region Specific Reports

High Value

Pre-Binding Reports

ROI Analysis

Here you can learn some ways to save on homeowners insurance before a problem arises.

If A Accident May A Rise? CALL YOUR AGENT ”Ask Questions!”

Call Your Insurance Agent!

1. They may have a Contractor they have used before!

They may have a Contractor they have used before!

2. Your Agent Deals with this all the time!

Your Agent Deals with this all the time!

Insurance Companies that PAY! “When there is an accident” Like a Good Neighbor

1. Ask a Neighbor

Ask a Neighbor

2. Ask a Friend

Ask a Friend

Don't underinsure

Insufficient coverage takes money from your pocket, and almost one in 10 of our subscribers who filed claims found themselves in that boat. Every few years, ask your insurer for a customized estimate of your home's replacement cost. To protect against the surge in the price of materials and labor that can follow a natural disaster, buy an extended-coverage rider, which adds up to 30 percent on top of your replacement value limit.

Take the ordinance or law-endorsement rider, which pays any extra cost of rebuilding your house to comply with the current local building codes. Get add-on coverage for sewer backup and a special endorsement or floater to cover the full value of expensive jewelry, silverware, or other valuables.

Buy home and auto coverage from the same company

One in seven of our readers who filed claims didn't tap this money saver, which can cut costs by up to 30 percent. If you're one of them, check with your auto and home carriers to see what savings each can offer by consolidating your insurance needs with the best one.

Raise your deductible

Almost half of our survey respondents had deductibles of $500 or less on their standard homeowners policy. But because insurance should be called on to cover bigger losses, not just a single broken window, a deductible of $1,000 is better: It will reduce the annual premium. Of course, build sufficient savings to cover that deductible if your luck runs out and you need it.

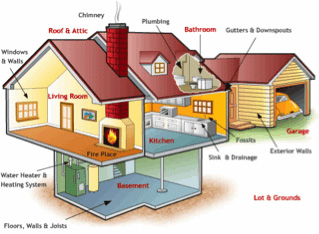

Nip loss risks in the bud

Even when losses are covered, they come with the cost of deductibles and other out-of-pocket expenses, and they can lead to higher future premiums. Avoid that by preventing losses from the perils particular to your region: Install impact- and fire-resistant roofing to guard against hail, debris, and wildfire embers, as well as storm shutters for doors and windows and hurricane-resistant siding. If you're at risk of earthquakes, make sure your home's frame is properly bolted to its foundation.

Substitute reinforced washing machine hoses for standard rubber ones to avoid the average $5,300 claim for water damage if the hose blows when no one is home. Never leave a stove unattended—a leading cause of home fires—and keep a fire extinguisher nearby. And tap insurer discounts for smoke and fire alarms, burglar alarms, and dead-bolt locks, which can cut 5 percent from your premium.